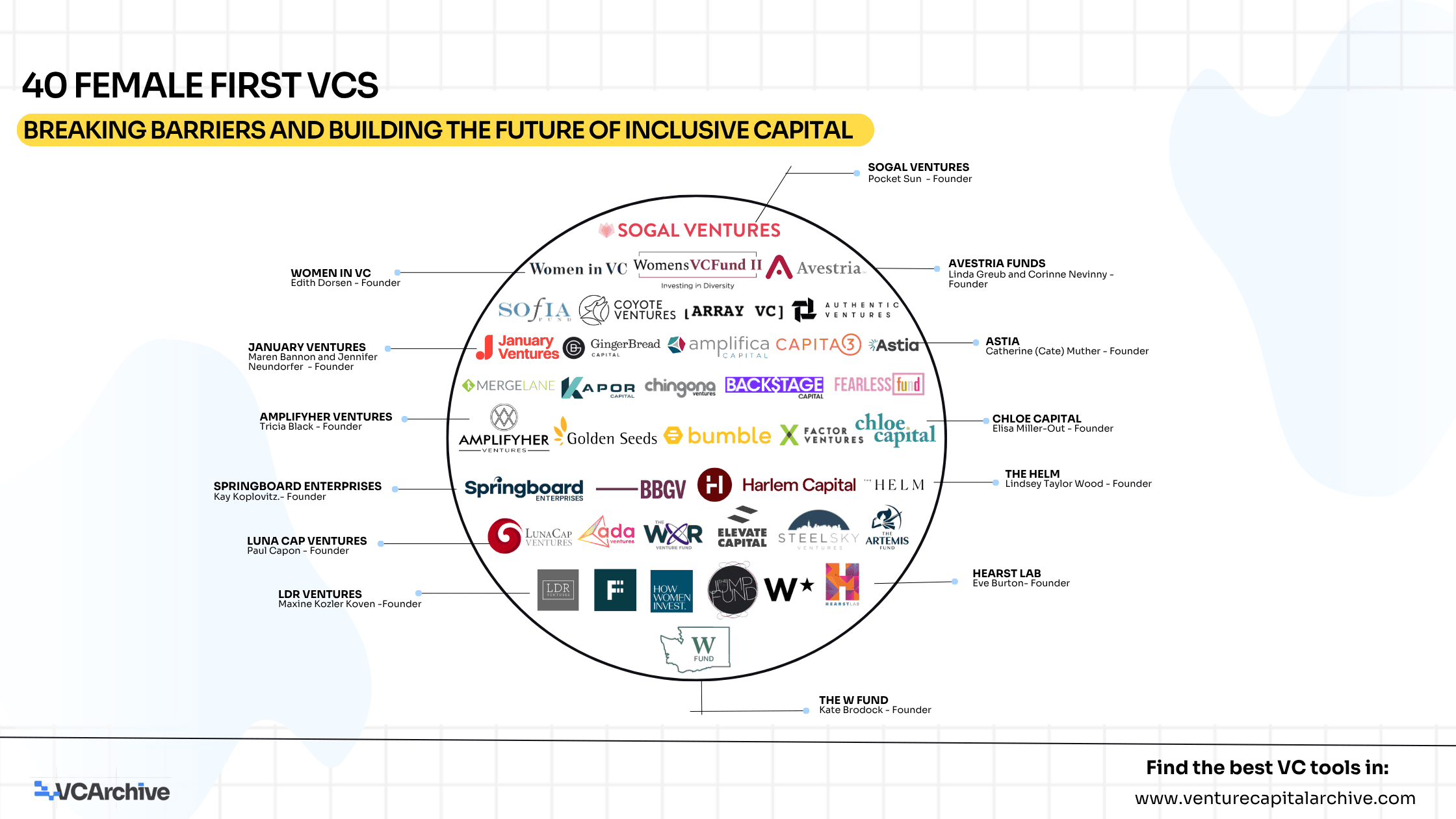

40 Female-First VCs

The 40 Female-First VCs featured here represent a global force transforming how innovation is funded. From London to Mexico City, San Francisco to Singapore, these investors are deploying capital not just with profit in mind but with purpose, equity, and long-term impact at their core.

1. Capital for Change: Diversity and Inclusion as Strategy

Firms like Backstage Capital (Arlan Hamilton) and Harlem Capital (Henri Pierre-Jacques, Jarrid Tingle) have become synonymous with closing the funding gap for women, people of color, and LGBTQ+ founders. Their model isn’t philanthropy, it’s performance.

Similarly, Amplifica Capital in Mexico City, founded by Anna Raptis, channels early-stage capital into women-led startups across Latin America, tackling systemic inequities from fintech to agritech. Authentic Ventures (Lindsay Lee) and The Artemis Fund (Stephanie Campbell, Leslie Goldman, Diana Murakhovskaya) are extending this ethos, providing hands-on guidance and funding for underrepresented founders in tech, commerce, and care sectors.

Together, these funds are proving that diversity is not a moral add-on, it’s a competitive advantage.

2. Women Investing in Women: Health, Wellness & FemTech

Few sectors illustrate the power of gender-lens investing like women’s health. Firms such as Avestria Ventures, SteelSky Ventures, and Coyote Ventures are leading the charge, addressing historically underfunded conditions that disproportionately affect women.

Avestria Ventures, co-founded by Linda Greub and Corinne Nevinny, invests in life-sciences startups tackling fertility, diagnostics, and preventive health. SteelSky Ventures, led by Maria Velissaris, is scaling companies like Zipline and Origin that expand access to healthcare delivery. Coyote Ventures, founded by Jessica Karr, adds a holistic dimension investing in physical, mental, and environmental wellness solutions for overlooked populations.

Meanwhile, funds like Capita3, Sofia Fund, and How Women Invest are bridging healthcare and leadership, ensuring more women build, lead, and scale solutions for women’s wellbeing.

3. Tech & Data-Driven Equity: From SaaS to AI Infrastructure

Women are also reshaping deep technology investing. Array Ventures, founded by Shruti Gandhi, is one of Silicon Valley’s most respected early-stage enterprise funds, backing data infrastructure and B2B SaaS startups. Ada Ventures in London (Matt Penneycard, Check Warner) brings a similar conviction to European tech, prioritizing inclusivity and climate-driven innovation.

January Ventures, co-founded by Jennifer Neundorfer, democratizes access to venture funding by empowering high-potential founders outside traditional networks. And WXR Fund, led by Martina Welkhoff and Amy LaMeyer, is championing women at the forefront of spatial computing and AI - a future few investors understand as deeply.

These firms are not following trends, they’re building the next generation of frontier tech.

4. Consumer, Commerce & Care: Redefining Market Leadership

Female-first investors are rewriting what growth markets look like. Amplifyher Ventures, founded by Tricia Black, and LDR Ventures (Lori Rosen) focus on women-led consumer and lifestyle brands, where authenticity drives loyalty. BBG Ventures, co-founded by Susan Lyne and Nisha Dua, invests in “the future majority” diverse founders solving problems for consumers historically ignored by mainstream capital.

In the U.S. South, The JumpFund (Kristina Montague) channels capital into women entrepreneurs across Tennessee and Georgia, creating regional hubs of female-led innovation. And in Europe, SoGal Ventures (Pocket Sun, Elizabeth Galbut) bridges East and West, investing in the “future of living, working, and staying healthy” across the U.S. and China.

Together, these funds reflect a new thesis: women-driven capital isn’t niche, it’s the growth engine of modern consumer markets.

5. Global Networks and Systemic Impact

Beyond capital, women investors are building ecosystems. Global Women in VC, founded by Anu Duggal and Jessica Peltz-Zatulove, connects more than 4,000 female investors worldwide. Springboard Enterprises, a long-standing accelerator, has launched over 850 women-led companies, including Zipcar, iRobot, and Constant Contact.

Organizations like Golden Seeds and WomensVCFund II continue to expand gender-diverse leadership pipelines, while Wocstar (Gayle Jennings-O’Byrne) brings a B-Corp ethos to funding women of color innovators, blending creativity, technology, and social responsibility.

These networks amplify capital with connection proving that systems change begins with collaboration.

The Shift Underway

This movement isn’t about representation, it’s about reinvention.

Female-first funds are reshaping the DNA of venture capital, shifting the focus from pattern-matching to problem-solving, from exclusion to expansion. They’re reimagining where innovation comes from, who gets to lead it, and what kind of world it builds.

Their portfolios show the future of capitalism: inclusive, data-informed, globally connected, and impact-conscious.

Explore the Full List

Discover the complete list of 40 Female-First VCs, including their check sizes, portfolio companies, and sector theses, exclusively on VCArchive a data-driven look at how women are shaping the next decade of innovation.

40 Female-First VCs

Rows per page